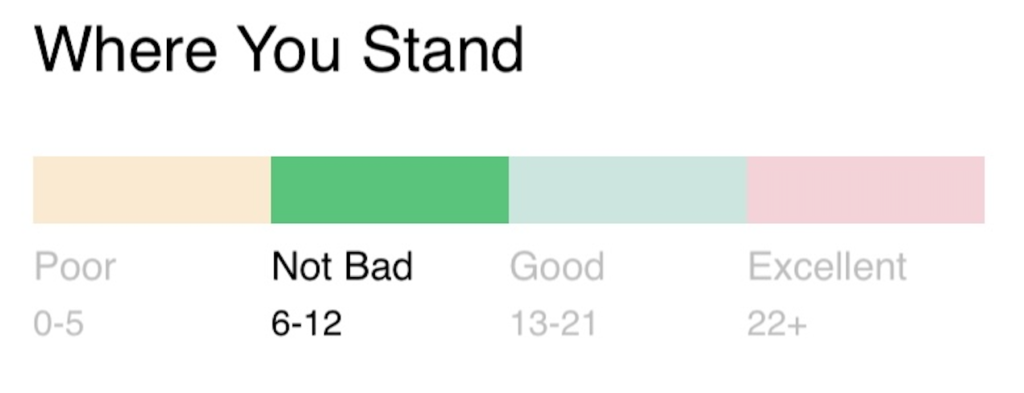

The above screenshot is not some random image from Google, it is from my credit report and yes, this is one of the factors that Credit Report Bureaus look at when they decide on your creditworthiness.

PLEASE NOTE: This approach might not work outside the USA, for one of the reasons listed below. Please be cautious while you plan to open more accounts. Open accounts include all

Reason 1

Having multiple credit cards can be beneficial for building credit and increasing your credit score. This is because having a higher credit limit across multiple accounts can reduce your credit utilization ratio, which is an important factor in determining your credit score. Additionally, using credit cards responsibly by making on-time payments and keeping your balances low can demonstrate to lenders that you are a reliable borrower.

However, it’s important to use credit cards wisely and avoid overspending or accumulating debt. Having too many credit cards can also be a risk if you’re unable to manage them effectively, which can lead to missed payments, late fees, and damage to your credit score.

Reason 2

Getting more credit cards (opening more accounts) will build your Credit Age strongly. Strongly here doesn’t mean that it will not change when you open a new account in the future, it means that the impact of a new credit account will not be as big as you had while getting your first credit card.

Please Note : Credit Accounts include Credit Cards, Mortgages, Car loans/leases, Student loans, or any other open accounts.

Let’s understand it from an example:

Suppose you have 3 credit accounts and the average age is 3 years across all the cards. Adding a new credit card today will cause the resulting age to be –

New Credit Age = (3x3+1x0)/4

= 9/4 = 2.25 That means your new Credit Age will be 2 Yrs 3 Months, a drop of 25%.

An alternative scenario is if you have 6 credit accounts with an average age of 3 years across all cards. Adding a new card –

New Credit Age = (6x3+1x0)/7

= 18/7 = 2.6That means your new Credit Age will be 2 Yrs 7 Months, a drop of only 13.8%.

And the more accounts you have, the stronger your credit score gets towards any upcoming fall due to new credit.

Let’s understand it from another example:

if you have 10 credit accounts with an average age of 3 years across all cards. Adding a new card –

New Credit Age = (10x3+1x0)/11

= 30/11 = 2.72That means your new Credit Age will be 2 Yrs 9 Months, a drop of only 9%

Reason 3

As we all know from my previous articles that credit utilization is an important factor in credit building, having multiple credit cards can help you distribute the utilization on all of them and also bring your overall utilization low by increasing your overall credit limit. This doesn’t mean that we have to go all in with more credit cards, you never want to spend what you cannot pay back. Will discuss a hack on how to reduce your credit utilization with heavy usage without impacting reward points in upcoming articles.

Conclusion:-

It is a myth that having more accounts is bad for your credit score. Obviously, it will drop your credit score when you open one, so you need to plan appropriately when you have an upcoming purchase coming up like a house or a car where the lender will make a soft/hard pull on your account because you do not want to get a big hit on your credit score just when you want it to be at its best. Plan it wisely, its your life and your credit score, and no one else is going to work on it.

Planning to get a new credit card, you can reach out to me for a discussion on the same if you feel confused at any time.

No responses yet