Before we start the discussion on how one can achieve the ideal credit score, we need to understand what all factors comprise/impact the credit score. We have 3 bureaus(Experian, Equifax & Transunion) that are always keeping a track of your credit score and all of them may have the same or different factors of consideration. Your score at each one of these bureaus is completely independent of your score from others. For example, an apartment manager who checks your credit may only look at Experian while a credit card company might only look at TransUnion.

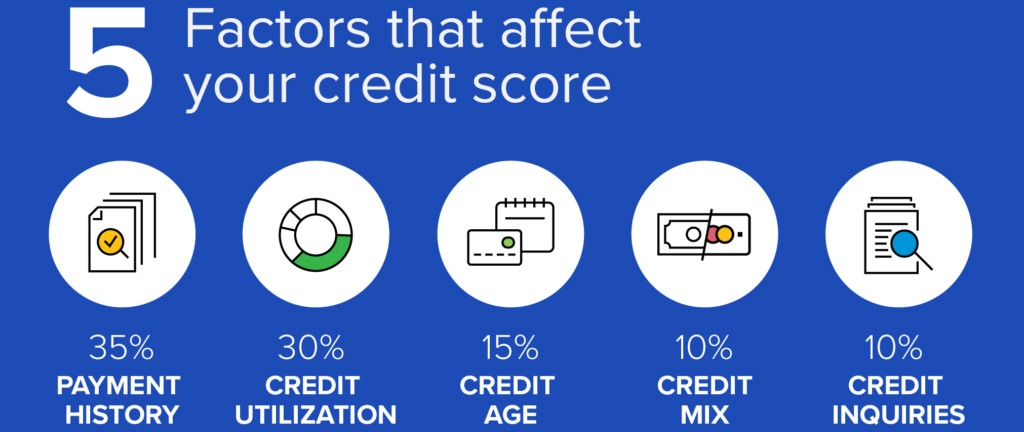

Some of the factors that impact credit scores are:-

- Credit Enquiries

- Credit Utilization

- Average Age/Credit Account

- Late Payments

- Credit Mix

Something that everyone should know is that these factors do not equally impact the credit score. We will talk about all these factors in detail.

- Credit Enquiries

Also, known as hard pull accounts for 10% of your credit scores. Your credit may be required for a number of purposes, including getting a house on rent, applying for a new credit card, etc. This all involves the lender making a credit pull on your account. This credit pull may be hard or soft depending on different criteria and this can be usually seen in disclaimers while submitting your social security number. While on one hand credit pull for renting an apartment will be a soft pull and will not impact the credit score, getting a mortgage on the other hand will hit the credit score significantly.

- Credit Utilization 30%

This is the percentage of credit used in all your accounts combined with the credit available in all your accounts. Some credit unions track the accounts individually and some track them combined. To give a deeper understanding of this, if I have 1 credit card with a $1000 limit, and my bill generates $700, the utilization will be

To be safe from the negative impact on your credit score, it is good to keep utilization below 30%, better to keep it under 10%, and best to keep it under 6%. You can read more on how you can reduce credit utilization on low-limit credit cards in [Article]

- Average Age of Credit Accounts 15%

This is as it says, average age of credit accounts, meaning for all the accounts that we have on the file, what is the average Age of all the associated accounts. This can easily be calculated using the formula

Average Age = (C1 x A1 + C2 x A2 + C3 x A3 …… Cn x An)/n

Please note: C1, C2 … Cn are just to denote the credits, their value remains 1 in all cases. Whereas A1, A2 … An are the respective age of accounts.

The formula eventually turns out to be:-

Average Age = (A1 + A2 + A3 …… An)/n

- Payment History

Most credit card lenders give you approximately 25 post your billing date to pay the billed amount (aka Statement Amount) and this is called the Due date. If you don’t make the minimum obligation payment (aka min pay due) by then you are marked as a defaulter and will be charged a late fee, along with that you are reported to credit bureaus and are marked as a defaulter for that month’s payments. As this factor comprises 35% of your credit scores, it is important to know how we can avoid this or take action if there is any default on your payments.

- Credit Mix

This shows what mix you have on your credit standing. The more different kinds of credit (mortgages, car loans, student loans, credit cards, etc.) you have, the you stand chance to develop a better credit score faster. While talking about the mix, the accounts are majorly classified as revolving accounts and installments account. Credit Cards are classified as revolving accounts whereas mortgage and student loan payments are categorized as installment accounts. Balance on revolving accounts can increase or decrease any cycle but the balance on installments account decreases Credit Mix comprises of 10% of your credit scores.

No responses yet